Agree Realty Starts 2024 Strong

Agree Realty (ADC) ADC 0.00%↑ reported a solid first quarter.

Introduced AFFO Guidance: $4.10 to $4.13

Consensus estimate $4.10

The implied growth rate is about 4.2%. That’s a bit better than I was expecting and better than the consensus estimate.

They also delivered a slight beat on estimates:

Core FFO per share: $1.01

Consensus estimate: $1.00

Beat: $.01.

Portfolio

One of the biggest factors in ADC’s ability to generate returns for investors is the acquisition process. Net lease REITs are almost always looking for external growth.

They can often issue a combination of debt and equity at a lower average cost of capital than the cap rate on their acquisitions.

This is one of the reasons it’s so important for a net lease REIT to have internal management and transparent disclosures.

They are regularly using the premium share price to accelerate growth in “per share” metrics.

Acquisitions:

Weighted-average cap rate: 7.7%

Weighted-average lease term remaining: 8.2 years

Total acquisitions: $123.5 million

Annual acquisition guidance: $600 million

Dispositions:

Weighted-average cap rate: 6.2%

Weighted-average lease term remaining: Not stated

Total dispositions: $22.3 million

Annual disposition guidance: $50 to $100 million

It’s normal for acquisitions to be much higher than dispositions for a net lease REIT. It would be quite strange to see anything else.

Acquisition Quality and Cap Rates

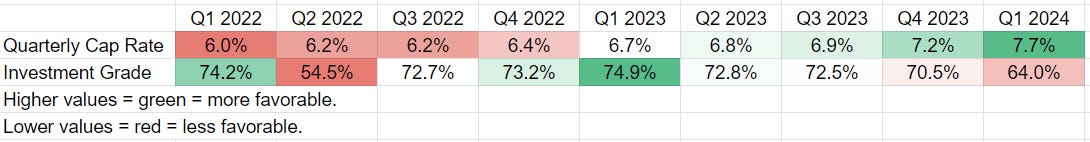

The cap rate for acquisitions jumped quite a bit this quarter:

ADC’s weighted-average cost of capital for these acquisitions is around 6.4% to 6.5%. To achieve a material spread, they needed to push cap rates higher.

Growth Rate

Guidance implies about a 4.2% growth rate in AFFO per share (rounded).

That’s pretty good for a REIT with a 5.1% dividend yield.

If we assume long-term returns would run at 9.3% (5.1% + 4.2% = 9.3%), that’s pretty good.

However, the growth rate can vary substantially between years.

Using AFFO per share:

Average growth rate from 12/31/2015 to 12/31/2022: 6.76%

Average growth rate from 12/31/2022 to 12/31/2028 (consensus estimates): 3.18%

Using Core FFO per share:

Average growth rate from 12/31/2015 to 12/31/2022: 7.16%

Average growth rate from 12/31/2022 to 12/31/2028 (consensus estimate): 2.9%

What’s causing such a big gap? Well, the growth rate in shares outstanding is a big factor.

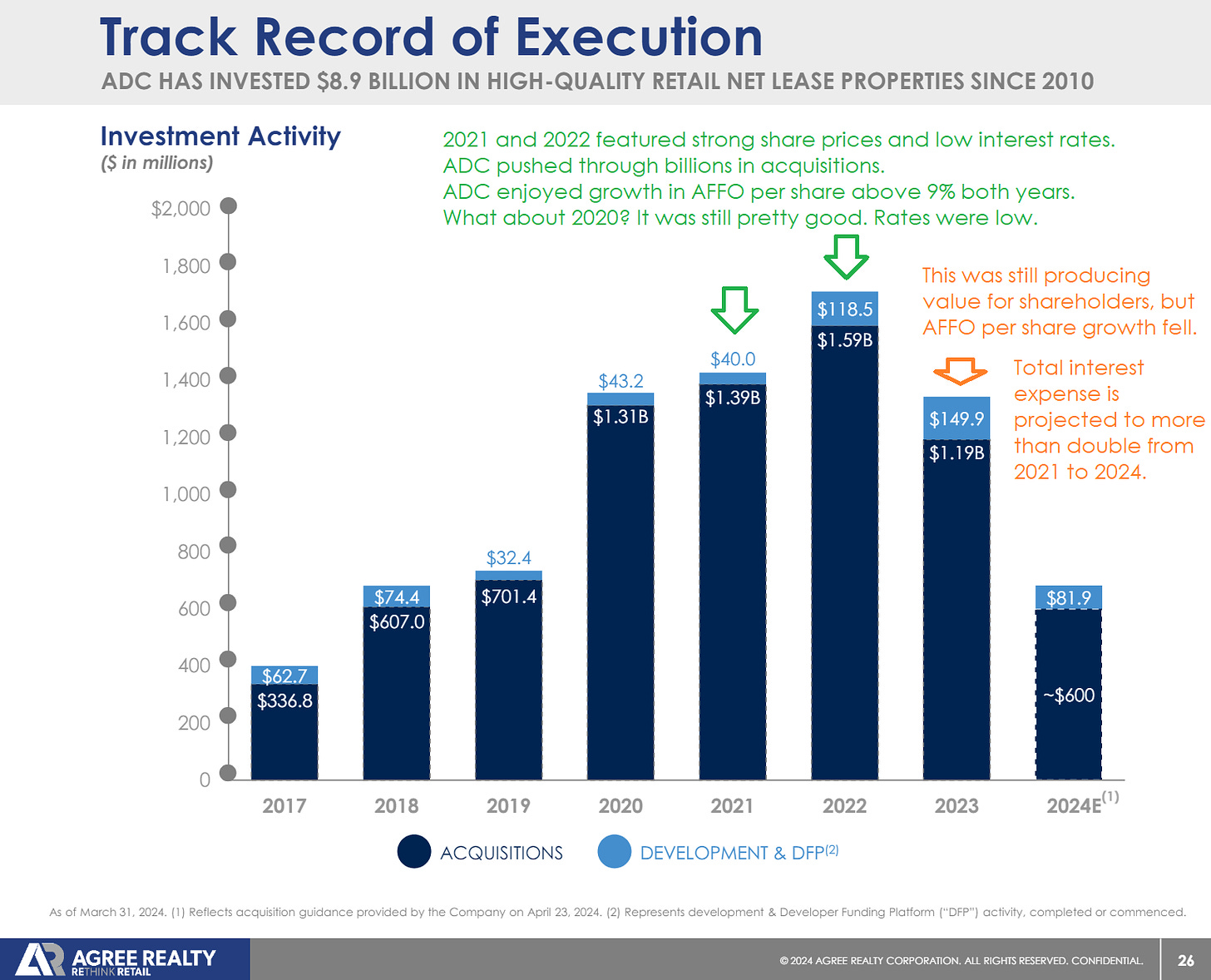

Since net lease REITs drive growth through accretive acquisitions, they can grow FFO and AFFO per share much faster when those are available.

Growth rate in weighted average shares (approximate):

Average growth rate from 12/31/2015 to 12/31/2022: 22.8%

Average growth rate from 12/31/2022 to 12/31/2028 (projected): 9%

Note: The second data set includes 2023, which had a bit over 20% growth. The projection excluding that would be 6.65%.

Second Note: I do not consider the implied projection for shares highly accurate. ADC may grow faster or slower. However, I wanted to emphasize how quickly ADC was growing (issuing shares & buying properties) in prior years.

The year where ADC was most active with acquisitions were also the years with the best growth in AFFO per share:

Debt

Maturities are low.

However, acquisitions are usually funded with a combination of equity and debt.

Consequently, ADC will still need to issue debt to maintain their acquisition pace.

These acquisitions are still materially accretive, so shareholders should still support this plan.

ADC already has about $237 million left to settle from forward sales.

What Are Forward Sales?

A forward sale is when the company locks in the price prior to issuing shares.

They have the right AND the obligation to issue shares at that price in the future.

It’s a bit annoying to model out, but it’s a good tool for funding acquisitions.

Conclusion

ADC’s portfolio management was excellent.

Solid growth in AFFO per share over several years.

Guidance for 2024 beat consensus expectations. It’s a bit better than I would’ve expected as well.

Acquisitions remain an important part of generating total returns.

ADC is working from a WACC (weighted-average cost of capital) around 6.4% to 6.5%.

Acquisitions came in at 7.7%, providing a 1.2% to 1.3% spread.

That’s pretty good for the current environment, but lower than needed to supercharge growth.

Pushing acquisition cap rates much higher could dilute the quality of the portfolio. Thankfully, ADC’s portfolio quality remains high. Their tenant quality improved over the last several years.

The big headwind facing ADC is the same as all other net lease REITs.

It’s harder to achieve huge spreads on acquisitions than it was from 2020 through 2022.

Further, they are competing against higher Treasury yields to attract capital from income investors.

Great quarter. Same macro headwinds remain. So far, ADC is navigating them better than expected.