All Housing REIT Target Updates

Brevity matters.

Brief version up top. Under 430 words. Everyone should read.

Details / context below (3,000+ words). For people who want more.

Same order in both sections.

Feedback encouraged.

This layout was inspired by Wes Kao’s advice: Start right before you get eaten by the bear.

Extra Note

I’ve temporarily unlocked Realty Income Buys Spirit Realty Capital: Math Ensues. The entire article will be free to all readers for the next week. All paid members already had it.

Brief Version

Updating equity REIT targets. Residential REITs today.

The factors impacting targets:

Interest Rates

Supply

Earnings

Brief Interest Rates

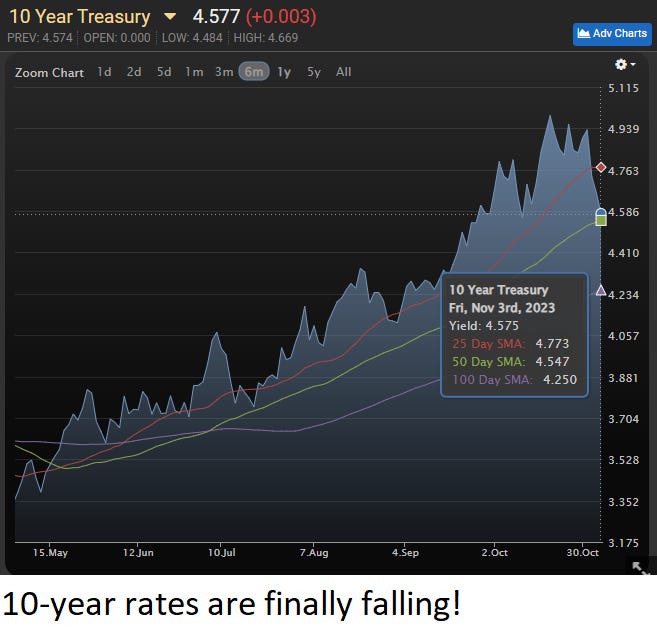

Rates ripped higher. Declined some.

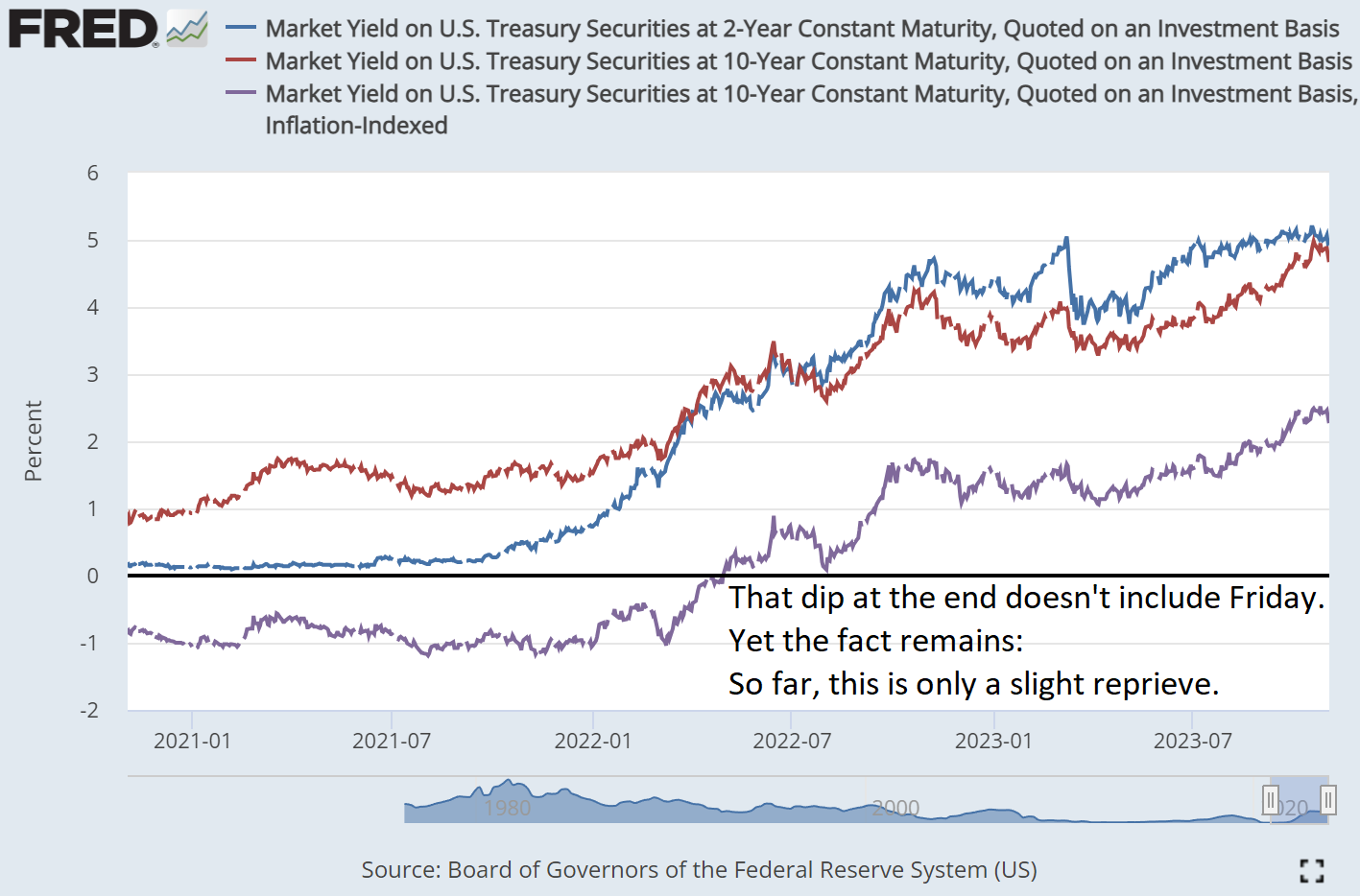

Seems like they fell quiet a bit, but really they are about even to October 11th, 2023. That’s not enough. Here’s a bigger chart for more rates:

Rates are down. REITs are ripping higher the last few days. But rates still need to decline much further. If they do, equity REIT targets will go up. For now, targets go down.

Brief Supply

Low rates drove investments in new apartment construction. Those apartments take 3 to 4 years to reach market. New supply hammers effective rental rates. Apartment ownership is not an oligopoly, so free markets work.

More supply = lower leasing spreads -> lower same-property NOI growth -> Lower FFO per share growth.

Brief Earnings:

The majority of REITs in the sector reduced:

Guidance for FFO

Guidance for same-property NOI.

Apartment rental spreads are getting weak. Should be weak until late 2025 or 2026.

Single-family and MH park rental spreads should be better than apartment spreads.

Brief Interest Rate Headwind Comparison

SUI had too much floating-rate debt. Bad for 2023. 2024 headwind is much smaller.

Entire sector has minor interest rate headwind for 2024. Should be about a 1% drag on FFO.

Brief Rent Growth

Leasing spreads going into 2024:

Apartments: -1% to +3%. Negative 1% is weak.

MH park REITs: +3% to +7%.

Single-family rentals: +3% to +8%.

Brief Same-Property NOI Growth

Roughly follows rent on with modest lag.

Lowest for apartments.

Higher for MH park and single-family rentals.

Brief FFO per share

Interest rate headwinds are smaller, so it should primarily follow same-property NOI. May have some distortion from new completions and from NOI that flows outside same-property NOI.

Expect growth rates to be lower than historical averages. Based on leasing spreads, year-over-year growth may be harder in the second half of 2024 and in 2025.

Estimates for SUI show flaws. Quarterly estimates don’t sum tor each annual. More than a rounding error.

Brief NAV Comparison

Historical average discount to NAV can be useful. Estimates for NAV are usually good. Estimates for SUI look flawed. Consensus estimates fell too much. I think those are wrong.

Brief Target Updates

Target Updates: