CCI Q2 2024 Earnings Update and Corrected Link for Member Poll

Crown Castle International (CCI) reported Q2 2024 results:

AFFO per share: $1.62

Beat estimates if you used $1.59.

Missed estimates if you used $1.65.

Different sources are reporting different consensus estimates.

That’s a bit annoying, but that part isn’t critical to our analysis.

Both TIKR and Seeking Alpha had at least one error in the data set. Specifically, mixing up FFO and AFFO at least once.

One of the sources had more errors, because they were conflicting on estimates.

Lovely.

Fortunately, we don’t need to have that data for our research. It’s nice, not critical.

Big Swing in Year over Year AFFO

The part that may be surprising to investors is the dramatic decline year over year. It appears to be down 21% or $.43 per share from $2.05.

Seems scary, but this is largely an accounting issue. There are a few factors that come into play:

Item 1: CCI included lease cancellation in AFFO. This inflated AFFO by $106 million and AFFO per share by $.244 in 2023.

Item 2: Interest expense increased by $22 million. That comes out to about $.0506 per share.

Item 3: Proxy advisory fees (the cost of defeating Boots Crapital, sorry “Boots Capital”) of $20 million. When they engage with such an awful plan to milk shareholders for money, it would be nice if they were forced to repay the company for the cost of defeating them. That was nearly $.05 per share.

Item 4: There’s also a significant amount of prepaid rent amortization. The change in prepaid rent amortization was $81 million. That is about $.186 per share.

There is room for reasonable debate over how to handle prepaid rent amortization. Accounting for prepaid rent amortization is simply a mess.

CCI might collect $10 million of rent in advance for a lease that lasts 10 years. Then they might record $1 million per year and collect the rest in cash.

On the other hand, they could also structure a deal so that there was no cash rent for the first 2 years. This would be much more complex and annoying.

Worse yet, they could mix and match between contracts.

Unfortunately, certain events such as a lease cancellation could require a retroactive change to lease amortization. That would require the company to either restate prior periods (awful) or send the entire adjustment through in the current period (also awful).

If Prepaid Rent Was Simple

The idea behind amortizing prepaid rent is to match revenue to occupied assets.

That’s a very good reason to amortize it.

Since the tenant paid for all or part of a given period by prepaying their rent, the tenant should be billed less. You would simply recognize the revenue for the appropriate period.

Imagine you have a tenant renting an apartment for $2,000 per month.

The tenant prepays you $800.

You would bill the tenant $1,200, because that is the amount that is due.

Total revenue is $2,000.

How does your revenue look?

Prior month: $2,000.

Current month: $2,000.

Next month: $2,100 because you raised rents.

If you completely ignore prepaid rents, the middle month would be $1,200. That’s not ideal.

Still Ranting

It would be better to just not have to deal with prepaid rent at all.

The issue is these contracts spanning several years with the potential for retroactive changes to create adjustments.

The adjustments lead to nonsense in quarterly reports.

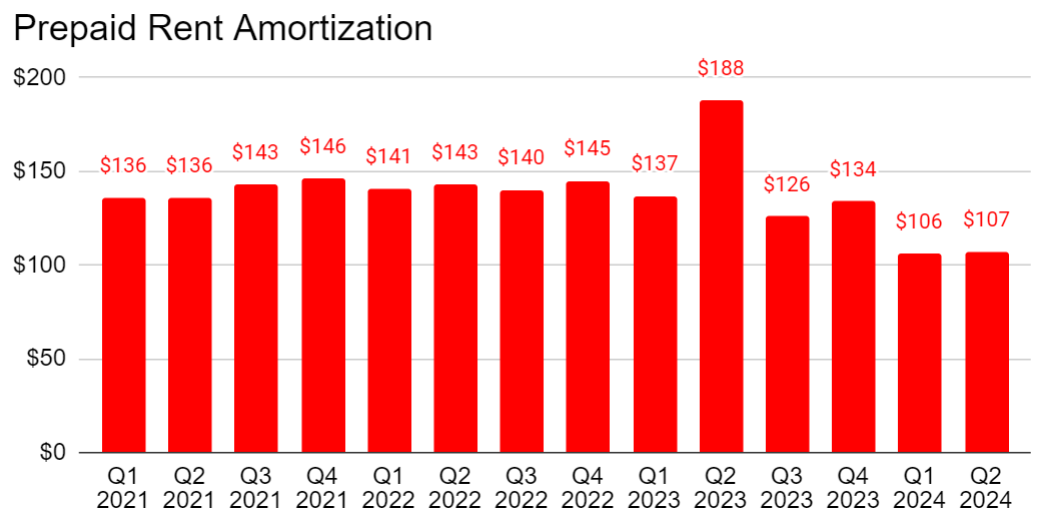

For instance, these are prepaid rent amortization figures for CCI over the last 14 quarters in millions of dollars:

You can see that in most periods, it’s relatively smooth. But then it also has a few sudden moves.

That would be fine, so long as those moves aligned with the periods where tenants were billed less.

If that were the case, it would be a non-issue.

You should also notice that Q2 2023 had an absurdly high number. That looks like CCI was including some significant adjustments for that quarter.

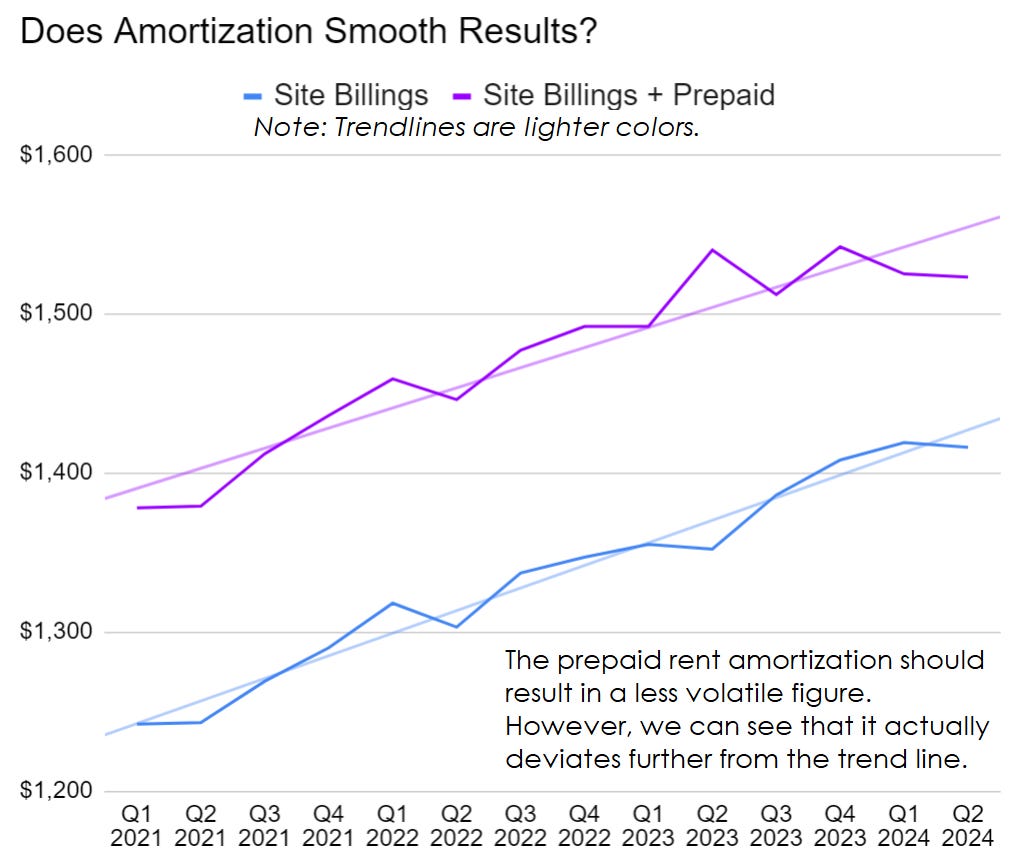

As you might predict, the prepaid rent amortization actually makes the line even more volatile.

The result looks like this:

Note: Normally I like using a zero bound for charts. It is usually appropriate. However, the point of this chart is to highlight which line is more volatile. Assuming you’re not superman with a world class monitor, this presentation is much easier to read.

Last Part of Rant

Prepaid rent can be an attractive source of cash to the REIT, but tenants aren’t borrowing at a significantly cheaper rate than CCI. CCI has their own investment grade credit rating.

If a tenant prepays rent, the tenant has to carry more debt (or less cash) because they gave the cash to CCI.

By “cash”, I’m referring to short-term Treasuries because not collecting interest income on millions would be stupid.

CCI likes prepaid rent as a way to reduce the current period cash outflows associated with development.

However, assuming tenants are not stupid, getting tenants to prepay rent requires other concessions. There is no free lunch.

Therefore, CCI could cease structuring deals to involve prepaid rent.

The cost of complexity in the financial statements easily outweighs any benefits unless tenants are remarkably stupid.

To be fair, Verizon (VZ) and AT&T (T) are major tenants.

Given the returns VZ and T failed to deliver as a result of wasting capital spanning decades, it’s possible that those two major tenants are simply that stupid.

If CCI is really happy with the prepaid rent structure, then it would be nice to have a breakdown of the sources of revenue and adjustments flowing through prepaid rent amortization for every quarter.

Guidance

Guidance was maintained relative to their June 2024 update (not from Q1 2024).

I still want to see them slashing capital expenditures even faster, but how many quarters can they announce a major reduction to capital expenditures? The June update included a dramatic reduction in capital expenditures, so they deserve credit for that.

Interest Expense

There was no change to interest expense or interest income guidance.

However, medium-term interest rates have decreased modestly since then.

That could mean they didn’t want to bother with a tiny adjustment, or they simply aren’t looking at refinancing floating-rate debt to fixed-rate debt.

Since short-term rates haven’t changed materially (and floating rates did change not at all), leaving guidance unchanged seems fine.

Commentary

Sometimes the prepared commentary on an earnings call is just management repeating numbers that are vastly better demonstrated in charts.

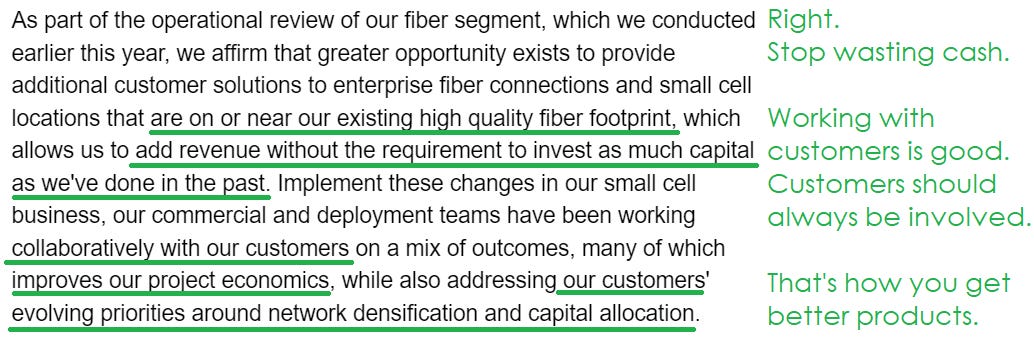

However, CCI’s prepared commentary had some useful commentary:

Source: Seeking Alpha for transcript, The REIT Forum for commentary

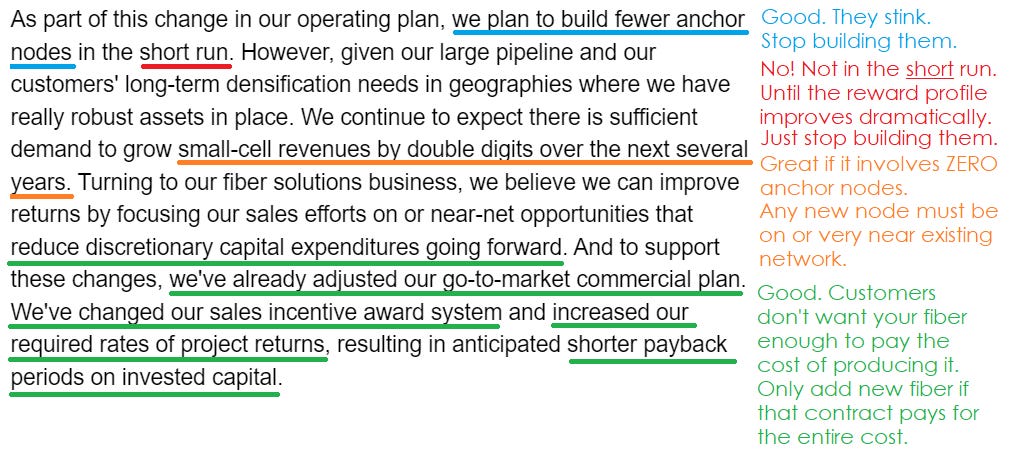

The next part was even better:

Source: Seeking Alpha for transcript, The REIT Forum for commentary

It is worth recognizing that anchor nodes could potentially be worth building.

For that to happen, they need:

A higher yield on their cost of development.

Sufficiently long contracts to ensure recovery of their costs.

Yields calculated looking at the full cost of that node. That means all costs of expanding the fiber network get factored in.

A respectable probability of a second tenant.

Many years ago, the target yield on anchor nodes was 6% to 7%. When interest rates were under 0.5% for 3-month rates and under 2% for 10-year rates, a lower rate of return was perfectly fine. Now it must be much higher. Management has agreed that they need a higher yield, though they aren’t stating what the explicit rate will be.

The difference between 8% or 9% isn’t that substantial compared to the importance of factoring in every dollar that goes to capital expenditures. If prior management had actually achieved a consistent 6% to 7% yield on every dollar they invested into the fiber and small cell space, CCI would be sporting more AFFO or less debt.

Conclusion

There was no change to guidance. No change to any other projections. No surprises for better or worse. Given the lack of change in fundamentals, I don’t see a reason to change targets.

Targets are maintained (0% change):

Encouraging Readers To Get Involved

Want to encourage a quick update on the REITs you care most about?

This is your change to get involved.

Our full members can use the following link to select the REITs they want to see prioritized for updates.