Scott Kennedy’s mREIT Earnings Series: Assessing Dynex Capital’s And AGNC Investment’s Performance For Q1 2024

Summary

This earnings assessment article reviews DX’s and AGNC BV and core earnings performance during Q1 2024 and compares results to my expectations. Earnings remain a key driver to stock performance.

DX’s BV matched my/our expectations (well within range) while its core earnings was a notable underperformance. DX’s operational expenses were negatively impacted by a large proportional increase in share-based compensation.

No change in DX’s percentage recommendation ranges or risk/performance rating. DX is currently deemed appropriately valued (HOLD). A pullback would first need to occur prior to considering a purchase.

AGNC’s BV slightly outperformed my/our expectations (within range) while its core earnings equivalent was a minor underperformance. These metrics basically “offset” each other.

No change in AGNC’s percentage recommendation ranges or risk/performance rating. AGNC is currently deemed overvalued (SELL) due to its large premium to CURRENT BV.

Formatting Change to this Article Series

We have recently changed the format of this earnings-related article series (less wording, more visual images). This process remains ongoing and future changes will likely occur.

1) DX:

Commentary

Quarterly BV Fluctuation: Nearly an Exact Match (At or Within 1.0%).

Core Earnings/EAD: Notable Underperformance.

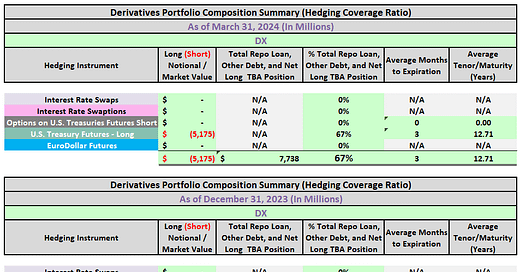

An “as expected” quarter on BV for Dynex Capital DX 0.00%↑ in my opinion. DX recorded a very minor quarterly BV decrease which was correctly anticipated. DX slightly decreased the company’s on-balance sheet fixed-rate agency MBS portfolio while notably increasing (proportionately speaking) its off-balance sheet net long TBA MBS position. DX also slightly increased the company’s net (short) U.S. Treasury futures position. When combined, all these activities led to a $0.05 per common share BV outperformance when compared to my expectations. When was offset by heavy use of the company’s at-the-market (“ATM”) equity offering program which ultimately led to BV dilution of ($0.07) per common share. This was additional BV dilution of ($0.05) per common share when compared to my expectations of only ($0.02) per common share.

DX’s notable core earnings/EAD underperformance was mainly due to an increase of $0.05 per share in share-based/equity compensation expenses during the quarter. This was disappointing but should be a “one-time” event. In addition, due to slightly decreasing DX’s on-balance sheet fixed-rate agency MBS portfolio while increasing the company’s net long TBA MBS position, this directly led to a slightly larger net spread and doll roll loss when compared to my expectations.

A risk/performance rating of 3.5 for DX remains appropriate in the current environment/over the foreseeable future (“higher-for-longer” regarding rates/yields).