Scott Kennedy's mREIT Earnings Series: Assessing Orchid Island’s Performance For Q1 2024 (Slight Outperformance)

Summary

This earnings assessment article reviews ORC’s BV and core earnings equivalent performance during Q1 2024 and compares results to my expectations. Earnings remain a key driver to stock performance.

ORC’s BV slightly exceeded my/our expectations (within range) while its core earnings equivalent was a minor-modest outperformance. No noteworthy surprises.

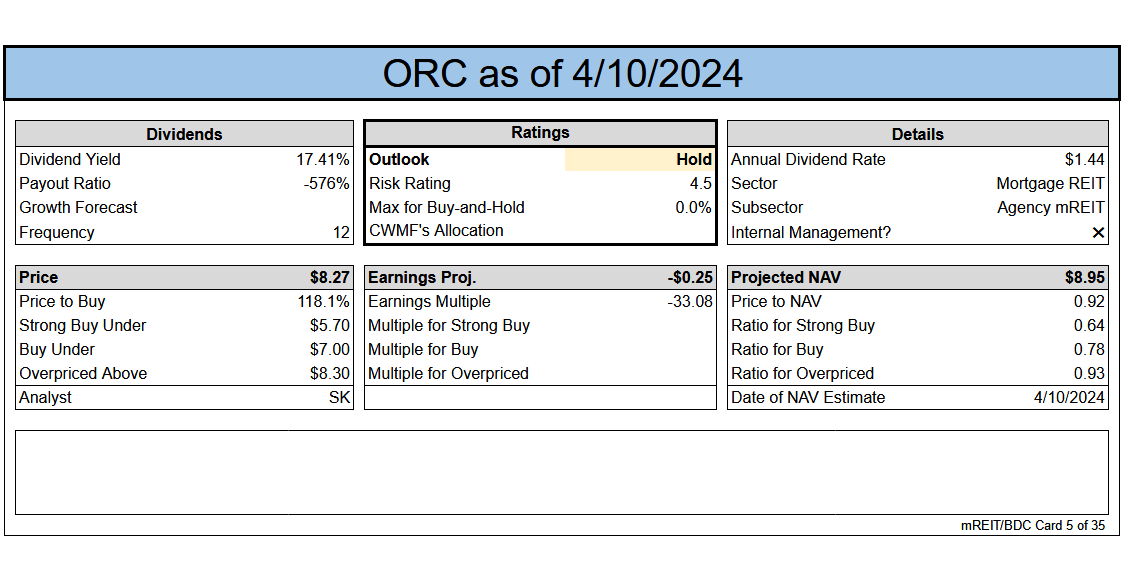

No change in ORC’s percentage recommendation ranges or risk/performance rating. ORC is currently deemed appropriately valued (HOLD). A modest-notable pullback would first need to occur prior to considering a purchase.

ORC’s quarterly relatively unchanged BV fluctuation will likely be similar to most sub-sector peers. I want to see continued improvement in ORC’s core earnings equivalent metric prior to an upgrade.

Formatting Change to this Article Series

We have recently changed the format of this earnings-related article series (less wording, more visual images). This process remains ongoing and future changes will likely occur.

Commentary

Quarterly BV Fluctuation: Minor (Nearly Modest) Outperformance.

Net Spread Less Operational Expenses (Core Earnings Equivalent): Minor - Modest Outperformance.

A bit of an encouraging quarter on both metrics for Orchid Island Capital (ORC) ORC 0.00%↑ in my opinion. ORC “eked out” a very minor quarterly BV gain while the company’s core earnings equivalent metric continued to slightly improve. ORC’s minor BV outperformance mainly stemmed from a slightly less severe decrease in the weighted average price decline of the company’s fixed-rate agency MBS sub-portfolio ((1.42) price decline versus my projection of (1.60)). In addition, a likely very minor outperformance within ORC’s derivative instruments valuation fluctuations. ORC’s quarterly core earnings equivalent improvement/outperformance was mainly due to a slightly more favorable decrease in the company’s weighted average repurchase agreement rate versus expectations. ORC’s very minor quarterly conditional/constant prepayment rate (“CPR”) increase was as anticipated. However, nothing “shell shocking” regarding ORC’s quarterly outperformance. As such, I don’t anticipate a performance/risk rating upgrade for ORC at this time. A risk/performance rating of 4.5 for ORC remains appropriate in the current environment/over the foreseeable future (“higher-for-longer” regarding rates/yields).

Change or Maintain

BV/NAV Adjustment (BV/NAV Used Interchangeably): Our projection for current BV/NAV per share was adjusted: Up $0.15 (To Account for the Actual 3/31/2024 BV/NAV Vs. Prior Projection). Price targets have already been adjusted to reflect the change in BV/NAV. The update is included in the card below and the subscriber spreadsheets.

Percentage Recommendation Range (Relative to CURRENT BV/NAV): No Change.

Risk Rating: No Change. Remains at 4.5.

Earnings Results

Note: BV at the end of the quarter. Subscriber spreadsheets and targets use current estimates, not trailing values.