The increasing yields on Treasuries remain a significant concern. However, I still want to acquire great companies at great prices. Of course, shares could still fall further. That’s the biggest risk here. We’re picking a REIT that has:

Fallen dramatically over the last 22 months.

Fallen substantially over the last 10 weeks.

Delivered outstanding growth in FFO per share over the last decade.

Demonstrated prudent decision-making by issuing shares when share prices were high and selling assets when share prices were low.

Achieved low cap rates on asset sales. Dramatically lower than today’s implied cap rates.

Trades Placed

Purchased 138 ARE at $96.7834

Alexandria (ARE) is still one of our smaller positions. But this increases the allocation quite a bit.

Commentary

ARE is the biotech lab REIT. Sometimes, ARE gets lumped in with office REITs, despite a long history of dramatically different performance on fundamentals.

Shares are clearly falling hard. They declined much more than REIT indexes. However, ARE has a few things going for them. One of the big ones is their balance sheet. ARE focused on fixed-rate debt and long maturities. They were hit hard during the GFC (Great Financial Crisis) and learned their lessons. The strong balance sheet is one of the things I find so attractive about this REIT.

Charts

First, this chart compares ARE with Vanguard’s REIT index (VNQ) and the high-yield equity REIT index (KBWY). I use both because it gives investors a more complete picture of the sector.

You can see that ARE performed quite well leading up to the end of 2021. However, they’ve fallen much harder since. That’s particularly interesting because ARE has one of the best balance sheets in the sector. Their BBB+ credit rating with a positive outlook was reaffirmed by S&P last week.

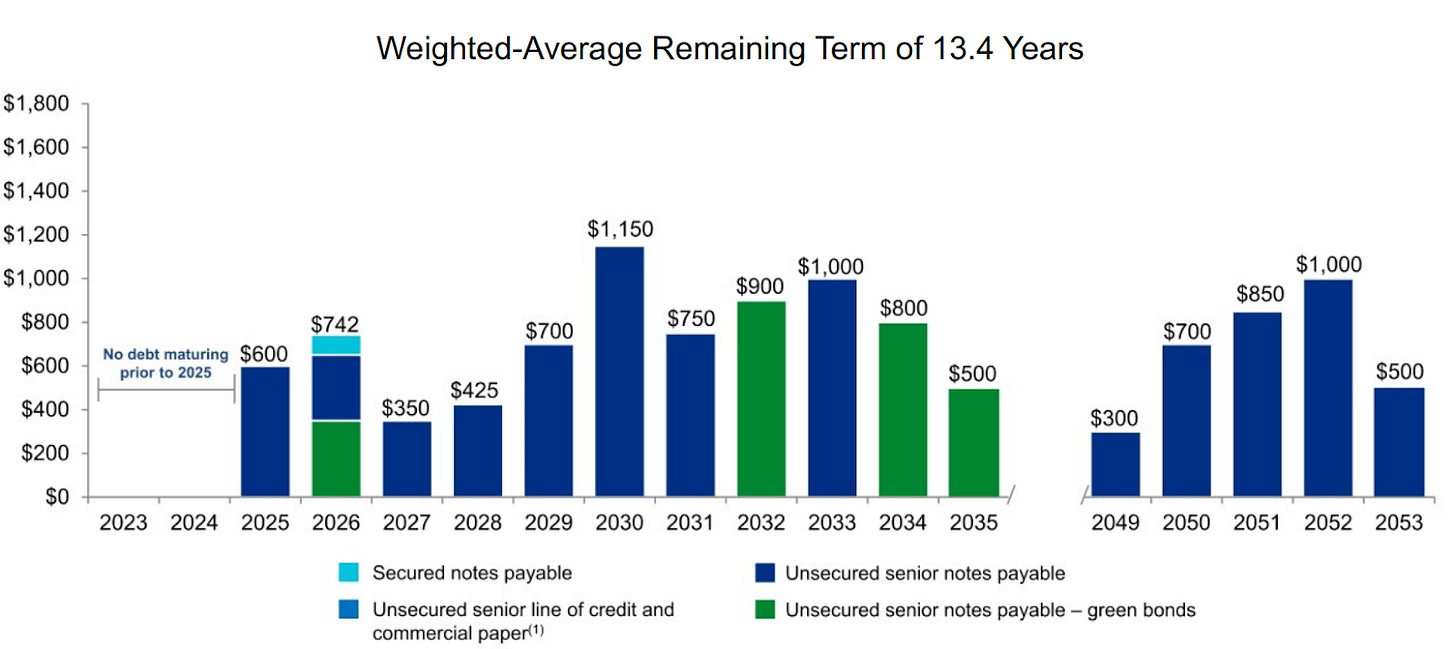

They have no debt maturities before 2025, and the maturities after that are not too big:

The vast majority of that debt (about 99%) has been fixed-rate. They should be better positioned to withstand higher rates than most other REITs.

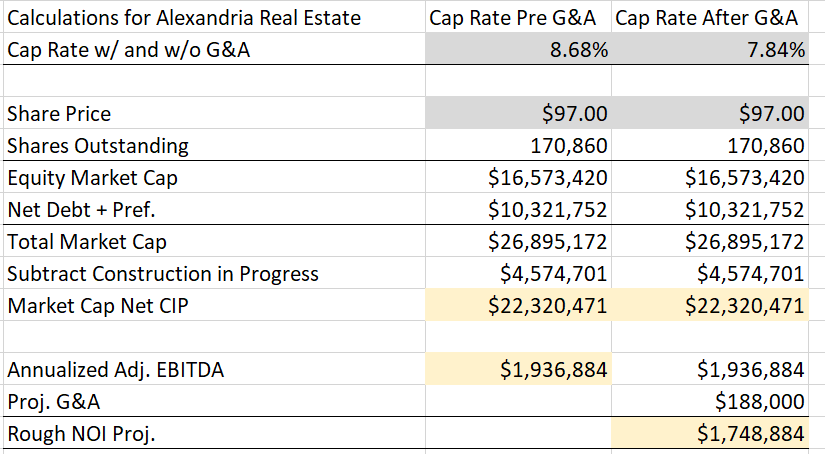

I ran some quick implied cap rate calculations for ARE at different potential price points back in July. I updated those to include the current price. They still use Q1 2023 figures, but the impact of swapping by one quarter should be minimal.

By my estimate, shares are trading at an implied cap rate of about 8.7% before G&A (General and Administrative expenses, which is basically overhead) and a cap rate of about 7.84% after G&A.

For comparison, they unloaded some assets at cap rates in the range of 4.5% to 5.4%. Even if we assume higher rates are continuing to pressure asset values, they won’t be close to the current implied values.

The history of FFO growth is outstanding, and you’ll notice the FFO multiple moved quite substantially: