Unveiling Annaly Capital Management: A Stock for Traders or Investors?

Summary

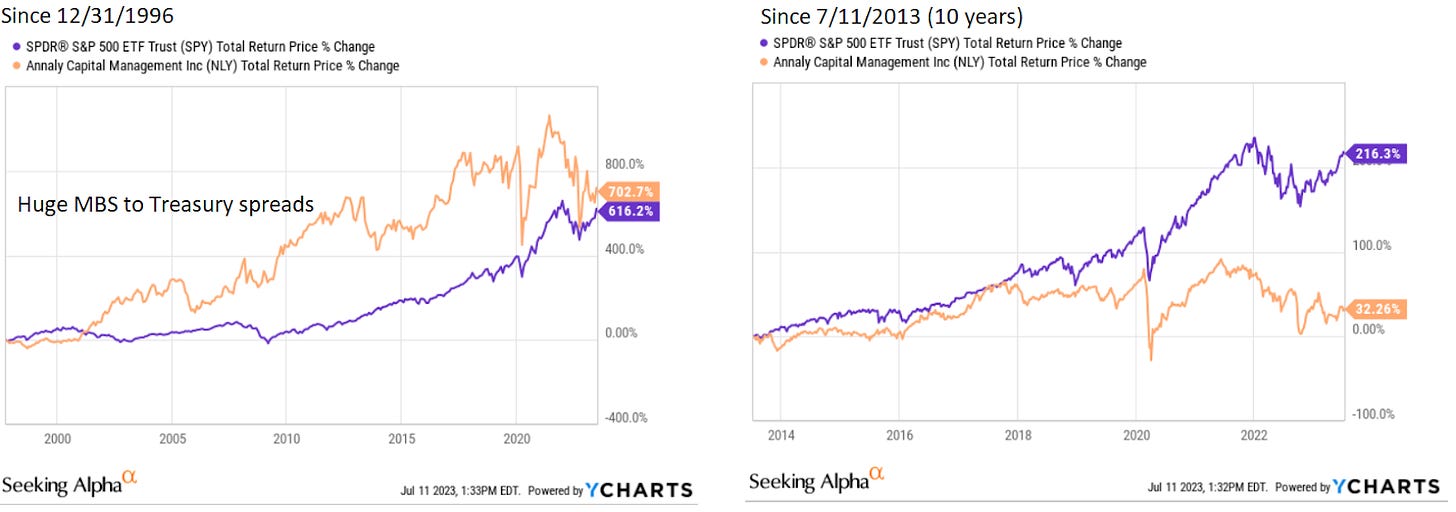

Mortgage REITs like NLY are much better for trading than investing.

Share prices aren’t good for either today.

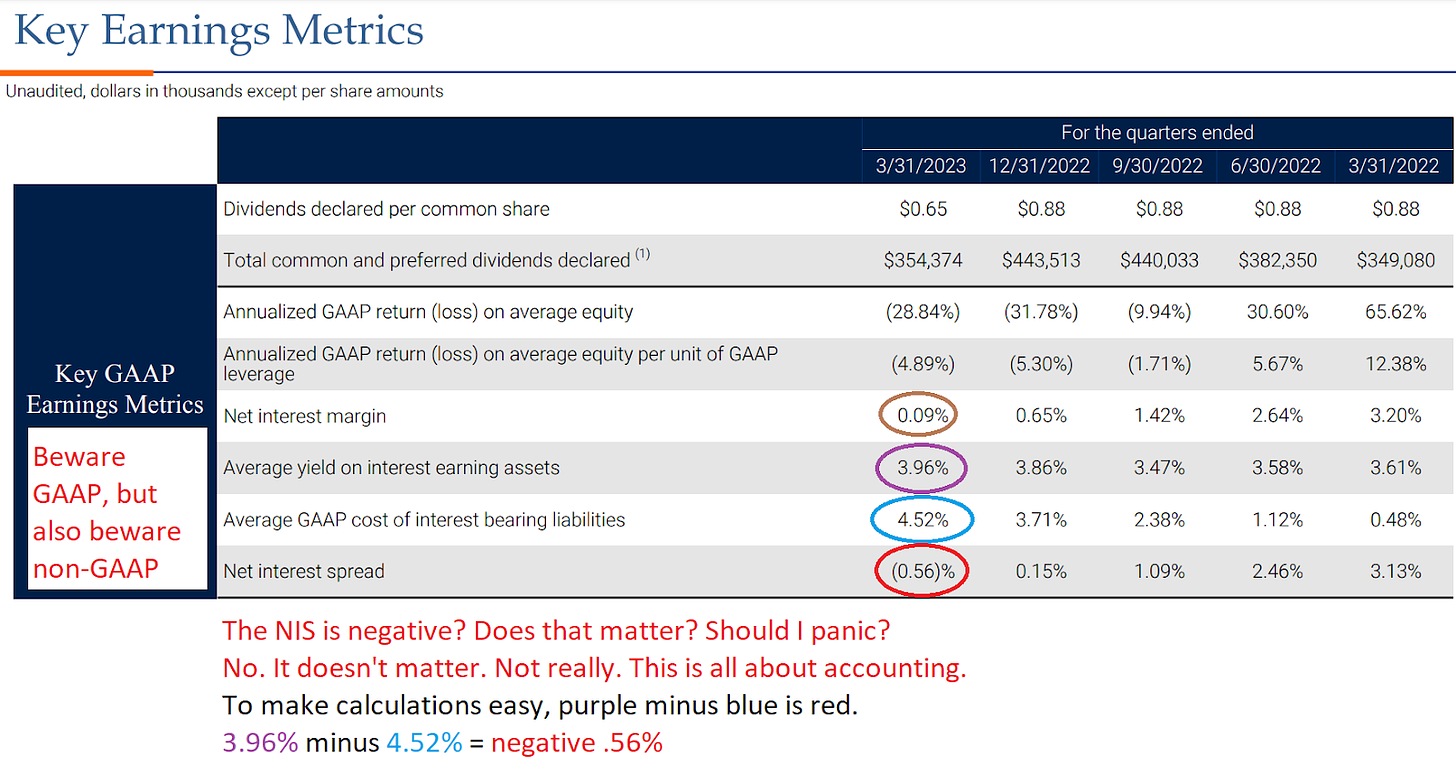

Investors and analysts get confused about net interest margins and net interest spreads.

I’ll demonstrate why you should be wary of putting too much weight on those metrics.

AGNC and ARR get a special call out for high price-to-book ratios. Bad

values. If I owned the common shares, I would be dumping them.

Article Starts

Is Annaly Capital Management (NLY) a long-term stock for income investors?

I say no. It is a stock designed for trading. The long-term performance looks good if you use a long enough frame. However, that frame needs to be longer than 10 years.

That can be a problem because the bond market changed materially during that time. The spreads on the assets NLY buys are smaller now. As a larger company with more coverage and more people (theoretically) understanding the business model, it is also harder to get a massive premium for issuing new shares.

Making It Easy

My goal is to make it easier for you to understand the company. Why? Because that’s how I get followers and subscribers. Consequently, I will focus on a few metrics and make them more accessible.

Net Interest Margins and Net Interest Spread

NIM (Net Interest Margin) and NIS (Net Interest Spread) are metrics for evaluating earnings.

NIM will be bigger than NIS. NIM allows the REIT to include the income generated from assets that were financed with equity. We’re going to talk about the NIS instead, but only briefly:

The NIS is negative. It doesn’t really matter all that much. These GAAP numbers are heavily impacted by accounting rules.

Now we’re going to expand the slide to include some non-GAAP metrics: